| Abstract In this paper we discuss a scaling approach to business fluctuations. Our starting point consists in recognizing that concepts and methods derived from physics have allowed economists to (re)discover a set of stylized facts which have to be satisfactorily accounted for in their models. Standard macroeconomics, based on a reductionist approach centered on the representative agent, is definitely badly equipped for this task. On the contrary, we show that a simple financial fragility agent-based model, based on complex interactions of heterogeneous agents, is able to replicate a large number of scaling type stylized facts with a remarkable high degree of statistical precision. Keywords: Business fluctuations; power law distribution; agent-based model. JEL classification: E32, C63, C82. 1. Introduction Recent explorations in industrial dynamics have detected two empirical regularities which are so widespread across countries and persistent over time to be characterized as universal laws: (i) the distribution of firms' size is right skew and can be described by a Zipf or power law probability density function (Axtell, 2001; Gaffeo et al. 2003); (ii) the growth rates of firms' output and countries' GDP follow a Laplace distribution (Stanley et al., 1996; Amaral et al., 1997). The fact that the distribution of firms' size is right skew is well known at least since Gibrat (1931). As a matter of fact, the strong form of Gibrat's law implies that the distribution is lognormal, while contemporary analysis points to the power law as the most accurate statistical description of the empirical distribution. It can be argued, however, that the weak form of Gibrat's law is not inconsistent with a power law distribution of firms' size. So far, the literature has dealt with (i) and (ii) as if they were independent stylized facts. In this paper we make three contributions. - We explore the link between the two, showing that the power law distribution of firms'size is at the root of the Laplace distribution of growth rates (i.e. we demonstrate that, under very general assumptions, (i) implies (ii)).

- We demonstrate that the features of business fluctuations such as the shifts of the distribution of firms' size over the cycle, the properties of the distribution of individual and aggregate growth rates and many others, are a consequence of (i).

- We discuss a model of financial fragility, empirically validated through conditioning (Brock, 1999), which generates (i).

In our approach the origin of business fluctuations - which is the most important single problem in macroeconomics - can be traced back to the ever changing configuration of the network of heterogeneous interacting firms. A major role in shaping dynamics is played by financial variables. The sequential timing structure of our economy implies that future markets are absent, so that agents have to rely on means of payment - here, bank credit extended to firms - to bridge the gap between agents' decisions and their realization.

Highly leveraged (i.e., financially fragile) firms, in

turns, are exposed to a high risk of default,

that is of going bankrupt. When bankruptcies occur, loans not refunded

negatively affect banks' net worth, with banks responding to their worsen

financial position by reducing credit supply. The reduction in credit

supply impacts on the lending interest

rate all other firms have to pay to serve their financial commitments.

The practice of combining heterogeneity and interactions is at odds with mainstream macroeconomics which reduces the analysis of the aggregate to that of a single representative agent and which is unable, by construction, to explain non-normal distributions, scaling behavior or the occurrence of large aggregate fluctuations as a consequence of small idiosyncratic shocks. While the industrial organization literature has explored at large the evidences (i) and (ii) at least since the 1950s, scarce attention has been paid so far to establishing a link to business cycle theory, mainly because mainstream macroeconomics lacks the adequate conceptual and analytical tools to accomplish such an endeavor.

Its reductionist methodology implies that in order to understand the working of a system, one has to focus on the working of each single element. Assuming that elements are similar and do not interact - i.e. the economy is completely described by a representative agent -- the dynamics of the aggregate replicate the dynamics of the sub-unit. This assumption requires that every element is in equilibrium. If the system is far from equilibrium, self-organizing phenomena and a state of self-organized criticality (SOC) may occur. According to the notion of SOC (Bak, 1996; Nørrelykke and Bak, 2002), scaling emerges because the sub-units of a system are heterogeneous and interact, and this leads to a critical state without any attractive points or states. The occurrence of a power law may be read as a symptom of self organizing processes at work. A notable example of this approach applied to macroeconomics is the inventory and production model developed by Bak et al. (1993). Alternatively, and in some sense in a way more germane to the economics discourse, power laws can be generated by models based on scale free growth processes. The basic idea can be traced back to the well-known Simon's model (Simon, 1955), where the Gibrat's law of proportional effects is combined with an entry process to obtain a Levy distribution for firms' size. Furthermore, recent work by physicists (e.g. Marsili and Zhang, 1998; Amaral et al., 1998) has shown that, by extending the heterogeneity of the system's components implied in Simon's scheme to account for direct or indirect interactions among units, power laws emerge naturally and, most notably, without the disturbing asymptotic implications of the original Simon's model or of its modern successors, like the one by Gabaix (1999). It is worthwhile to stress that, regardless of the modeling strategy one chooses, the adoption of the scaling perspective in economics implies rejecting the very definition of a representative agent because the dynamics of the system originate from the interaction of heterogeneous agents. We believe that, in order to grasp the empirical evidence and provide a coherent framework, economists have to adopt a methodological approach based on heterogeneous interacting agents (HIA) (see Delli Gatti et al., 2003a, for an example). A step in this direction is the agent-based modeling strategy, which is increasingly applied also in economics. Agent-based models have been developed to study the interaction of many heterogeneous agents. In a sense they are based on new microfoundations. The relevance and reliability of these microfoundations are grounded in the empirical evidence they can account for. Microfoundations can be defined as sound if they produce an economic behavior coherent with the empirical evidence, not necessarily with some optimizing principle. The main shortcuts and the analytical weaknesses of the representative agent hypothesis are dealt with in Section 2, where the pros of the HIA methodology are also illustrated. Section 3 is devoted to discuss the relationship between power law distributions and the business cycle. Section 4 introduces the model (whose simulative details can be found in the Appendix) and discusses its dynamical properties. Section 5 deals with simulation results, focusing on their consistency with the empirical evidence on some business cycle facts (5.1), and on the conditional properties of the model (5.2). Section 6 concludes. 2. Representative Agent, heterogeneous agents and interaction: a methodological digression Mainstream economics is based on reductionism, i.e. the methodology of classical mechanics. Such a view is coherent if the law of large numbers holds true, i.e.: the functional relationships among variables are linear; and, there is no direct interaction among agents. Since non-linearities are pervasive, mainstream economics generally adopts the trick of linearizing functional relationships. Moreover agents are supposed to be all alike and not to interact. Therefore an economic system can be conceptualized as consisting of several identical and isolated components, each one being a representative agent (RA). The optimal aggregate solution can be obtained by means of a simple summation of the choices made by each optimizing agent. Moreover, if the aggregate is the sum of its constitutive elements, its dynamics cannot but be identical to that of each single unit. The ubiquitous RA, however, is at odds with the empirical evidence (Stoker, 1993), is a major problem in the foundation of general equilibrium theory (Kirman, 1992), and is not coherent with many econometric investigations and tools (Lippi and Forni, 1997). All in all, we may say that macroeconomics (and macroeconometrics) still lacks sound microfoundations. The search for natural laws in economics does not necessarily require the adoption of the reductionist paradigm. Scaling phenomena and power law distributions are a case in point. If a scaling behavior exists, then the search for universality can be pushed very far. Physicists have shown that scaling laws are generated by a system with strong HIA (Marsili and Chang, 1999; Amaral et al., 1998) and therefore are incompatible with reductionism. As a consequence, the occurrence of scaling laws in economics is incompatible with mainstream economics. The macroscopic pattern (consisting of a multitude of heterogeneous interacting units) works as a unified whole independent of the dynamical process governing its individual components. The idea that systems which consist of a large number of interacting agents generates universal, or scaling, laws that do not depend on microscopic details is now popular in statistical physics and is gaining momentum in economics as well. The quantum revolution of last century radically changed the perspective in contemporary physics, leading to a widespread rejection of reductionism. According to the holistic approach, the aggregate is different from the sum of its components because of the interaction of particles. The properties of the sub-units are not intrinsic but can be grasped only analyzing the behavior of the aggregate as a whole. The concept of equilibrium is therefore different from that of mainstream economics. The equilibrium of a system does not require any more that every element is in equilibrium, but rather that the aggregate is quasi-stable, i.e. in "... a state of macroeconomic equilibrium maintained by a large number of transitions in opposite directions" (Feller, 1957, p. 356). In terms of a power law distribution, it means that firms are located along a curve whose coefficient is stable and the intercept changes very slowly over time. This is due to the fact that the data generating process is random: in terms of the state of a process we may say that the transition from one state to another is affected by chance as well by agents' systematic actions. In the model of Section 4, output fluctuations are due to: 1) a random process on current revenues as a consequence of imperfect information on actual prices; 2) systematic interactions among agents. The distribution is quasi-stable over relatively long periods because it represents "... slowly changing, age-dependent characteristics of a population which ages and renews itself only gradually" (Steindl, 1965, p.142). This means that, since firms are born small, their growth takes time and mortality decreases with age and size, the slow change of the distribution comes as a consequence. In a nutshell: the distribution is stable, or quasi-stable, because the dissipative force of the process (here, the Gibrat's law) produces a tendency to a growing dispersion, which is counteracted by a stabilizing force (i.e., the burden of debt commitments and the associated risk of bankruptcy). Moreover, distributions are interconnected. The population is characterized by a joint distribution of several variables (in our model: equity, capital, debt, age, equity ratio), which is completely inconsistent with the RA framework. The change of firms' distribution (and the business cycle itself) has to be analyzed in terms of changes of the joint distribution of the population. 3. Gibrat, Pareto, Laplace: the statistical analysis of industrial dynamics In this section we set up and discuss some statistical foundations for the results that will be presented in Section 5. As already pointed out, in our HIA framework the analysis of business cycles is intertwined with the properties and evolution of the firms' size distribution, which in turn is empirically well approximated by a power law. A well known object mainly in physics and biology, the power law distribution has been originally derived more than a hundred years ago by Vilfredo Pareto, who argued that the distribution of personal incomes above a certain threshold y0 follows a heavy-tailed distribution (Pareto, 1897). In particular, he showed that the probability to observe an income Y greater than or equal to y is proportional to a power of y:

(1) (1)

with a close to 1.5. This fact immediately started to baffle scholars given that, under the reasonable assumption that the rates of growth of income brackets are only moderately correlated, the Central Limit Theorem implies that the income distribution should be lognormal. This conundrum regarding the limiting distribution of multiplicative stochastic processes became explicit about 30 years later in industrial economics, thanks to the pioneering work of Gibrat (1931). Gibrat claimed that - the law of proportional effects holding true, i.e. that the growth rate of each firm is independent of its size (Gibrat's law in weak form) - the distribution of firms' size must be right skewed. He went even further, arguing that, if the rates of growth are only moderately correlated, such distribution must be a member of the log-normal family (Gibrat's law in strong form).

In a nutshell, the size (measured by output, capital

stock or number of employed workers)

of the i-th firm KiT in period T is defined

as  , where giT

is the rate of growth. Taking the log of both sides and solving back recursively

from a time 0 size Ki0, it is straightforward to obtain , where giT

is the rate of growth. Taking the log of both sides and solving back recursively

from a time 0 size Ki0, it is straightforward to obtain

. .

Assuming that the growth rates are identically independently distributed, the distribution of the log of firms' size tends asymptotically - i.e. for t approaching infinity - to the lognormal distribution. Notice that from Gibrat's analysis one would expect the distribution of firms' growth rates to be normal. Recent empirical research (Axtell, 2001; Gaffeo et al., 2003) has shown, however, that the distribution of firms' size follows a Zipf or power law instead of a lognormal distribution. Moreover, Stanley et al. (1996) and Amaral et al. (1997) have found that the growth rate of firms' output z i follows, instead of a normal distribution, a Laplace distribution:

(2) (2)

where b > 0 is the scale parameter. To explain this puzzle, the literature has followed two lines of research. The first one is a-theoretical and focuses only on the statistical properties of the link between the distribution of the state variable (firms' size) and that of the rates of change. For instance, Reed (2001) shows that independent rates of change do not generate a lognormal distribution of firms' size if the time of observation of firms' variables is not deterministic but is itself a random variable following approximately an exponential distribution. In this case, even if Gibrat's law holds at the individual level, firms' variables will converge to a double Pareto distribution. The second line of research - to which the model described in the following section belongs - stresses the importance of non-price interactions among firms hit by multiplicative shocks, hence building on the framework put forward by Herbert Simon and his co-authors during the 1950s and 60s (Ijiri and Simon, 1977). As a matter of example, Bottazzi and Secchi (2003) obtain a Laplace distribution of firms' growth rates within Simon's model, just relaxing the assumption of independence of firms' growth rates. This result can be further generalized, in that a Laplace distribution for growth rates can be derived as soon as the size of the state variable under scrutiny is Pareto distributed. As discussed in Palestrini (2003), one can start from the definition of the growth rate as the log-difference of the state variable's levels, so that the proof consists in showing that: 1) the logarithm of a Pareto random variable follows an exponential distribution; and 2) the difference of two exponential random variables becomes a Laplace distribution. Proposition 1) may be proved using the monotonic property of the logarithmic function and the rule of transformation of random variables. Assuming that x follows a Pareto distribution with parameter a it is possible to derive the probability distribution of Y = log(X):

(3) (3)

that is, an exponential distribution with parameter a. In the case of independent exponential variables, proposition 2) can be proved - albeit in a more cumbersome way - using the convolution theorem and its relation with the characteristic function. Furthermore, one can show that the causal relationship between Pareto (for levels) and Laplace (for growth rates) distributions holds also in the general case, but the shape of the Laplace distribution of growth rates changes over the business cycles (Palestrini, 2003). In particular, the scale parameter b decreases during expansions and increases during recessions. The main message looming large from the statistical results discussed so far is that the scaling approach to business fluctuations derives in the first place from the levels of state variables being distributed as a power law. Thus, the basic question to be answered is whether scale invariance for state variables' levels is a general feature of economic systems or not. From this viewpoint, it emerges that power law probability functions arise endogenously in economics basically for two reasons: 1) the lack of a characteristic scale in empirical and theoretical economics, implying that the occurrence of either rare or frequent events (i.e., sizes) is governed by the same law (Zajdenweber, 1997); 2) a power law behavior in the tail(s) of a distribution is a feature of a family of distributions known as Lévy-stable distributions. Due to a generalization of the central limit theorem (Gnedenko and Kolmogorov, 1954), the sum of a large number of identical and independent random variables has a probability density function characterized by a four-parameter characteristic function M(t), which in logarithm reads as:

(4) (4)

where 0 < a £ 2 is the stability parameter, g is a

positive scale factor, m is a real number, and b is the skewness parameter

ranging from -1 to 1. Expanding M(t) in Taylor series it is possible

to show (e.g., Mantegna and Stanley, 2000) that the probability density

function of a Lévy random variable x is, in the tails, proportional

to  . .

Lévy distributions are stable under convolution, meaning that the sum of N identically independently distributed (iid) a -stable Lévy variables is also Lévy distributed, with the same stability parameter a .

When a = 2, b = 0 and  ,

the distribution is Gaussian with mean m and variance s 2. ,

the distribution is Gaussian with mean m and variance s 2.

The Gaussian family is the only member of the Lévy class for which the variance exists. The presence of second moments implies that, if disturbances hitting firms are only idiosyncratic ones, aggregate fluctuations disappear as the number of firms N grows large.

In fact, without aggregate shocks the variance of the

average output of N firms is less than the maximum variance of

firms' output, say  , a quantity

that, for N going to infinity, vanishes. On the contrary, stable

distributions with a < 2 do not need aggregate shocks to generate aggregate

fluctuations. , , a quantity

that, for N going to infinity, vanishes. On the contrary, stable

distributions with a < 2 do not need aggregate shocks to generate aggregate

fluctuations. ,

Figure 1. Comparison between two simulated economies, inhabited by 10000 firms each. In the first economy (black line) agents' size distribution is Pareto with location parameters k = 1 and stability parameter a = 1.5. In the second economy (grey line) agents' size distribution is lognormal, with the same mean (i.e., 3) and same estimated variance at t=0 (i.e., 10.4) of the other economy. The plot describes the two time series of agents' average output, Ypa (the time evolution of the mean of the Pareto distributed firms) and Yln (the time evolution of the mean of the lognormal distributed firms). The difference between the two situations may be well described by the example depicted in Figure 1, where we report the average output time path of two economies identical but for the shape of their firms' size distributions. In the first economy firms are Pareto distributed, whereas in the second one the distribution of firm's size is lognormal. Output is assumed to be proportional to size. Time series have been obtained by averaging from samples extracted from the two distributions at any time period t. The time evolution of the average output shows almost no aggregate fluctuations for the lognormal economy, but large fluctuations in the Pareto economy even in the absence of aggregate shocks. In particular, the variance of the average aggregate output in the Pareto case is one order of magnitude greater than the variance of the lognormal case. Put differently, stable Pareto-Lévy distributions are good candidates to explain aggregate large fluctuations in time periods characterized by small aggregate shocks. In what follows, we build on the HIA framework developed in Gallegati et al. (2003) and Delli Gatti et al. (2003a) to put at work all the notions we surveyed in this section, by modeling an economy characterized by aggregate scaling behaviors due to multiplicative idiosyncratic shocks and interactions among firms. 4. Financial fragility and business fluctuations: a model Consider a sequential economy, with time running discretely in periods t = 1, 2,..., populated by many firms and banks. Two markets are opened in each period: the market for an homogenous produced good, and the market for credit. As in the levered aggregate supply class of models first developed by Greenwald and Stiglitz (1990, 1993), our model is fully supply-determined, in the sense that firms can sell all the output they (optimally) decide to produce. Due to informational imperfections on the equity market, firms can raise funds only on the credit market. The demand for credit is related to investment expenditure, which is therefore dependent on banks' interest rates. Total credit supply, in turn, is a multiple of the banks' equity base, which is negatively affected as insolvent borrowing firms go bankrupt. As we will discuss below, this mean-field interaction provides a mechanism to create long-range inter-temporal correlations capable to amplify and propagate idiosyncratic shocks. 4.1 Firms At any time period t, the supply side of the economy consists of finitely many competitive firms indexed with i = 1, ..., Nt, each one located on an island. The total number of firms (hence, islands) Nt depends on t because of endogenous entry and exit processes to be described below. Let the i-th firm uses capital (Kit) as the only input to produce a homogeneous output (Yit) by means of a linear production technology, Yit = f Kit. Capital productivity (f ) is constant and uniform across firms, and the capital stock never depreciates. The demand for goods in each island is affected by an iid idiosyncratic real shock. Since arbitrage opportunities across islands are imperfect, the individual selling price in the i-th island is the random outcome of a market process around the average market price of output Pt, according to the law Pit = uitPt, with expected value E(uit) = 1 and finite variance. By assumption, firms are fully rationed on the equity market, so that the only external source of finance at their disposal is credit. The balance sheet identity implies that firms can finance their capital stock by recurring either to net worth (Ait) or to bank loans (Lit), Kit = Ait + Lit. Under the assumption that firms and banks sign long-term contractual relationships, at each t debt commitments in real terms for the i-th firm are ritLit, where rit is the real interest rate. If, for the sake of simplicity, the latter is also the real return on net worth, each firm incurs financing costs equal to rit(Lit + Ait) = ritKit. Total variable costs proportional to financing costs, gritKit, with g > 1. Therefore, profit in real terms (p it) is:

. (5) . (5)

and expected profit is E(p it) = (f - grit)Kit. In this economy, firms may go bankrupt as soon as their net worth becomes negative, that is Ait < 0. The law of motion of Ait is:

,

(6) ,

(6)

that is, net worth in previous period plus (minus) profits

(losses). Making use of (5) and (6), it follows that the bankruptcy state

occurs whenever:

.

(7) .

(7)

As in Greenwald and Stiglitz (1990, 1993), the probability

of bankruptcy ( ) is incorporated

directly into the firm's profit function because going bankrupt costs,

and such a cost is increasing in the firm's output. Assuming for expositional

convenience that uit is uniformly distributed on the

support (0,2), and that bankruptcy costs are quadratic, ) is incorporated

directly into the firm's profit function because going bankrupt costs,

and such a cost is increasing in the firm's output. Assuming for expositional

convenience that uit is uniformly distributed on the

support (0,2), and that bankruptcy costs are quadratic,  with

c > 0, the objective function takes the form: with

c > 0, the objective function takes the form:

.

(8) .

(8)

From the first order condition, the optimal capital stock is:

. (9) . (9)

Thus, the desired capital stock in t is

decreasing (non-linearly) with the interest rate and it increases linearly

with financial robustness, as proxied by the t- 1 net worth.

Time period t desired investment

is simply the difference between the desired capital stock and the

capital stock inherited from the previous period,  . .

To finance it, the i-th firm recurs to retained

profits and, if needed, to new mortgaged debt,  ,

where D Lit = Lit - Lit-1.

Making use of (4), the demand for credit is given by: ,

where D Lit = Lit - Lit-1.

Making use of (4), the demand for credit is given by:

. (10) . (10)

4.2 The banking sector

We model the banking sector in terms

of the reduced form from the working of an oligopolistic industry.

The balance sheet of the banking sector is ,

with Lt being total credit supply, Et

the banks' equity base and Dt deposits which, in this

framework, are determined as a residual. ,

with Lt being total credit supply, Et

the banks' equity base and Dt deposits which, in this

framework, are determined as a residual.

To determine the aggregate level of

credit supply, we assume that banks are subject to a prudential rule

set up by a regulatory body such that  ,

where the risk coefficient n is constant. Hence, the healthier are

banks from a financial viewpoint, the higher is the aggregate credit supply

(Hubbard et al., 2002). ,

where the risk coefficient n is constant. Hence, the healthier are

banks from a financial viewpoint, the higher is the aggregate credit supply

(Hubbard et al., 2002).

Credit is allotted to each individual firm i on the basis of the mortgage it offers, which is proportional to its size, and to the amount of cash available to serve debt according to the rule:

(11)

(11)

with  , , ,

and 0 < l < 1. ,

and 0 < l < 1.

The equilibrium interest rate for the i-th firm is determined as credit demand (10) equals credit supply (11), that is:

.

(12) .

(12)

where k it-1 and a it-1 are the ratios of individual to total capital and net worth, respectively.

Under the assumption that the returns on the banks'

equity are given by the average of lending interest rates  ,

while deposits are remunerated with the borrowing rate ,

while deposits are remunerated with the borrowing rate  ,

the banks' profit ( ,

the banks' profit ( ) is given

by: ) is given

by:

(13) (13)

with  being

the spread between lending and borrowing rates. being

the spread between lending and borrowing rates.

Note that w , which in what follows will be treated parametrically, captures the degree of competition in the banking sector: the higher is w , the higher is the interests' spread which, in turn, increases with a higher monopolistic power of banks. When a firm goes bankrupt, Kit < Lit. In this case, the banking sector as a whole registers a loss equal to the difference between the total amount of credit supplied up to time period t and the relative mortgage, Bit = Lit - Kit = - Ait, where Ait < 0 if firm i belong to the set of bankrupt firms W t. Let us call Bit bad debt. The banking sector's equity base evolves according to the law of motion:

.

(14) .

(14)

Through the banking sector's equity base law of motion, idiosyncratic real disturbances leading to a bankruptcy have systemic consequences: an increase of bad debt forces the aggregate credit supply shifting to the left, thus raising the financial costs due to a higher interest rate, ceteris paribus. Furthermore, the distribution of firms' net worth influences the average lending interest rate, which in turn affects the bank's profit and, eventually, credit supply. Thus, firms dynamically affect each other through indirect interactions. In particular, interactions are global and independent of any topological space, and they occur through a field variable, which in our case is the banking sector's balance sheet (Aoki, 1996). Interactions, if strong enough, allow the system to escape from the property of square root scaling for sums of iid shocks due to the Central Limit Theorem. It is well known from statistic theory (e.g, Resnik, 1987) that as N grows large, independence of idiosyncratic disturbances implies that the volatility of the system decays with the square root of size, leading to a power law distribution with exponent b = - 0.5. If distant agents are sufficiently correlated through interactions, in turn, aggregate volatility decays more slowly, according to a power law with exponent b < - 0.5. The empirical evidence reported in Amaral et al. (1997) for companies and in Canning et al. (1998) for countries goes precisely in this direction. 4.3 Firms' demography Recent empirical work has shown that firms entering and exiting markets contribute almost as much to employment and macroeconomic fluctuations as firms continuing their activity (e.g., Davis et al., 1996). Hence, any theory of business fluctuations should pay particular attention to the way entry and exit of firms are modeled. In our framework, exits are endogenously determined as financially fragile firms go bankrupt, that is as their net worth becomes negative. Besides making the total output to shrink, exits cause the equity of the banking sector - and, in turn, aggregate credit - to go down. As discussed above, this mean field interaction in terms of a bank effect (Hubbard at al., 2002) amplifies and propagates idiosyncratic shocks all over the economy. As regards entries, the literature has suggested models ranging from exogenously defined purely stochastic processes (Winter et al., 1997), to models where entry is endogenous in that the number of entrants depends on expected profit opportunities (Hopenhayn, 1992). Alas, the available evidence has been so far inconclusive. Caves (1998), for instance, claims that the only firm points are that entrants are in general largely unsure about the probability of prospective success, and that entries does not occur at a unique sector-specific optimal size.

Our modeling strategy aims at capturing these facts by

means of a mechanism in which a probabilistic process is affected by

prospective performance, and entries can take place at different sizes.

First, the number of new entrants ( )

is obtained by multiplying a constant )

is obtained by multiplying a constant  >

1 to a probability which depends negatively on the average lending interest

rate: >

1 to a probability which depends negatively on the average lending interest

rate:

(15) (15)

where d and e are constants.

The higher is the interest rate, the higher are financial

commitments, and the lower are expected profits, with entries being lower

in number. Second, entrants' size in terms of their capital stock is drawn

from a uniform distribution centered around the mode of the size distribution

of incumbent firms, each entrant being endowed with an equity ratio ( )

equal to the mode of the equity base distribution of incumbents. )

equal to the mode of the equity base distribution of incumbents.

4.4 Long-run dynamics In order to understand the long-run - i.e., growth - properties of our economy, it is convenient to consider a deterministic version of the model. Indeed, abstracting from uncertainty means getting rid of heterogeneity, so that we can easily keep track of the dynamic behavior of a representative firm. If the interest rate is assumed constant, from (5), (6) and (9) it turns out that the law of motion of the net worth is:

(16) (16)

The solution of this first order difference equation

returns the steady state gross growth rate of the economy,  ,

which implies positive growth whenever ,

which implies positive growth whenever  :

whenever the return to capital is higher than its cost, the economy is

characterized by endogenous growth. This result is far from surprising

as soon as we note that in our model the production function exhibits

constant returns to the only input that can be accumulated, which is the

same engine of growth as in the well-known AK endogenous growth

model developed by Rebelo (1991). :

whenever the return to capital is higher than its cost, the economy is

characterized by endogenous growth. This result is far from surprising

as soon as we note that in our model the production function exhibits

constant returns to the only input that can be accumulated, which is the

same engine of growth as in the well-known AK endogenous growth

model developed by Rebelo (1991).

This analogy can be further extended to appreciate the

special role played by credit in our economy. First, recall that in the

Rebelo's model the steady-state growth rate depends positively on the

saving rate. In our partial equilibrium analysis

savings are implicitly defined as the difference between investment

and retained profits, so that

at each time period t total savings are equal to banks' loans.

Indeed, changes in the banking regulatory regime or in the competitive pressure in the banking sector end up affecting the equilibrium lending interest rate, and through it the long-run growth rate. 5. Simulation results The complexity of the model directs the analysis of its high-frequency properties towards computer simulation techniques. Figures 2 and 3 exhibit the evolution of an artificial economy lasting 1000 time periods, implemented using the framework analyzed in the previous section with a starting number of 10000 firms. In particular, in Figure 2 we show the time path of the logarithm of total output, whereas in Figure 3 it is drawn its volatility expressed in terms of output's growth rates. From Figure 2 it emerges that our stochastic economy, buffeted with iid idiosyncratic disturbances only, is characterized by sizable aggregate fluctuations; that its growth process displays a broken-trend behavior (Perron, 1987); and that Great Depressions (e.g., the one during the simulation time period 855-880) can suddenly punctuate its time path, due to bankruptcies of great firms that origin remarkable impacts on the business cycle via the financial sector (Gabaix, 2003). The output series possesses an autocorrelation parameter equal to 0.99. Interestingly, before large downturns our model seems to exhibit a common pattern: starting from a constant growth trend, the economy gains momentum with accelerating growth and increasing volatility, to subsequently move into a deep recession.

Figure 2. Logarithm of the aggregate output. The first 150 periods have been deleted to get rid of transients. Furthermore, as shown in Figure 3, fluctuations as measured by output's growth rates are characterized by cluster volatility, a well known phenomenon mostly in the financial market literature due to the heavy tails character of asset returns' distributions (Cont et al., 1997). The growth rates' standard deviation is 0.0289.

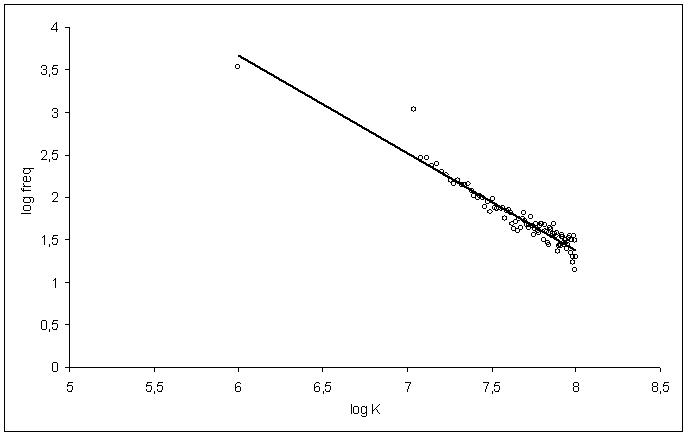

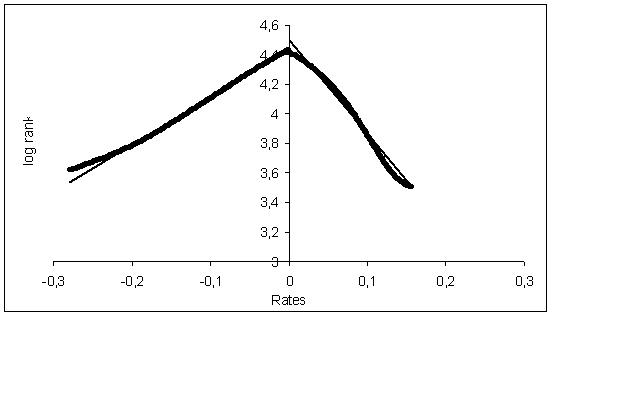

Figure 3. Growth rates of aggregate output. 5.1 Firms' size and growth rates distributions In Figure 4 we report the Zipf plot for firm sizes recorded at simulation time period 1000. In agreement with recent empirical results (Axtell, 2001) the firms' size distribution is skewed and it follows a power law. Furthermore, the scaling exponents recorded (a = 1.11) are consistent with what found in real data (Gaffeo et al., 2003). As widely shown in the complexity literature, the emergence of such a distribution is deeply correlated with the hypothesis of interaction of heterogeneous agents that is at the root of the model. More specifically, the interaction among units buffeted with multiplicative iid shocks leads the system's dynamics to a complex critical state in which no attractive point or state emerges. In terms of business fluctuations, it means that there is not a single and determinate equilibrium, but a non-stable state emerges after each recessive or expansive episode. The firms' size distribution tends to shift to the right during growing phases, while during recessions the estimated stability parameter a decreases. In fact, during expansions greater firms tend to grow faster than smaller ones, causing a higher slope of the interpolating line if compared with the situation observed during recessions. On the contrary, bankruptcies of great firms during downturns cause a more equal distribution of the size distribution. Once again, this is precisely what observed in real data (Gaffeo et al., 2003).

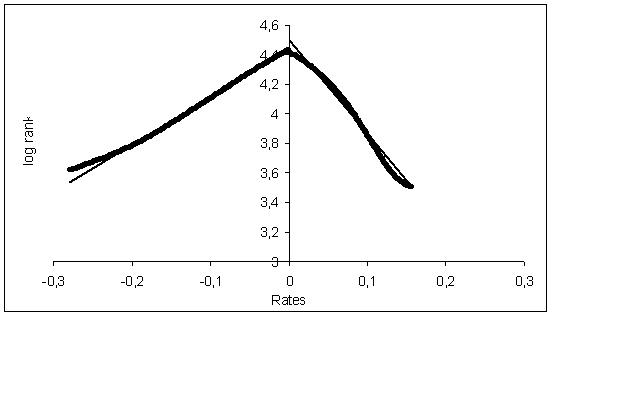

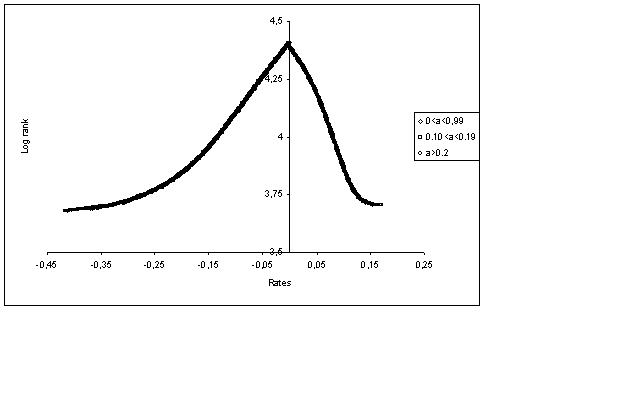

Figure 4. Zipf plot of firm sizes. Stanley et al. (1996) and Bottazzi and Secchi (2003), among others, find that the growth rates of firms are generally well fitted by a Laplace (or double exponential) distribution. As discussed in Section 3, such a finding can be shown to derive from firms' size being distributed as a power law. In fact, simulated data for firms' growth rates, reported in Figure 5, are well approximated by a (asymmetric) Laplace distribution. In another stimulating paper, Lee et al. (1998) show that binned growth rates for firms and countries' GDPs settle on the same regression line in a log-log plot. If analyzed from a complex perspective, this result signals the presence of self similarity, i.e. the behavior of greatest units (countries) reproduces the behavior of smaller units (firms), possibly corrected by a scale factor (Durlauf, 2003). As shown in Figure 5, where we plot the distribution of the growth rates of aggregate output, this feature has been recorded in our model as well. The difference of parameters between the firms' growth rate and the aggregate output growth rates distributions is sensible, in our simulations, to the modeling choice for the production function, though we do not have at this stage any analytical result to prove it.

Figure 5. Distribution of firms growth rates.

Figure 6. growth rates of aggregate output.

The model is capable to display several other striking

similarities with observable facts. In particular: 1) the frequency

of firms' exits seems to be well approximated by an exponential function

of firms' age (Steindl, 1965; Fujiwara, 2003); 2) bad debt,

that is the amount of unpaid loans due to bankruptcies extended by the

banking sector, follows a stretched exponential distribution (Delli

Gatti et al., 2003d); 3) profits

are power law distributed, and exhibit time reversal symmetry (Fujiwara,

2003); 4) expansions and recessions, measured as trough-to-peak

and peak-to-trough

of the GDP growth rates time series,

are distributed as a Weibull (Di Guilmi et al., 2003); 5) the

rate of return on the capital  and

the equity ratio ai are positively correlated; 6)

a higher equity ratio is associated with a lower volatility

of profits, the last two facts being consistent with the evidence

one can obtained by analyzing the sample of firms in Bureau van Dijk's

AMADEUS, a commercially available data set. and

the equity ratio ai are positively correlated; 6)

a higher equity ratio is associated with a lower volatility

of profits, the last two facts being consistent with the evidence

one can obtained by analyzing the sample of firms in Bureau van Dijk's

AMADEUS, a commercially available data set.

5.2 Conditional distributions In this subsection we address a typical aggregation issue, known as the mixture problem, which is likely to negatively affect the reliability of results as soon as scaling plots are taken into account (Brock, 1999; Durlauf, 2003). Roughly speaking, the mixture problem asserts that, when aggregating economic units with different behaviors, it is possible to observe marginal distributions with heavy tails even though conditional distributions do not possess such a property. In other terms, a power law may appear simply because heterogeneous units governed by different stochastic processes are erroneously mixed, instead of signaling the invariant properties of a unique Lévy-stable underlying stochastic process. In fact, if the latter is the case one should observe the same scaling behavior independently of which conditioned sub-sample is considered. In fact, the mixture problem may be present in our work, since the model described in Section 4 implies different behaviors according to the financial position of firms, as well as differently aged firms.

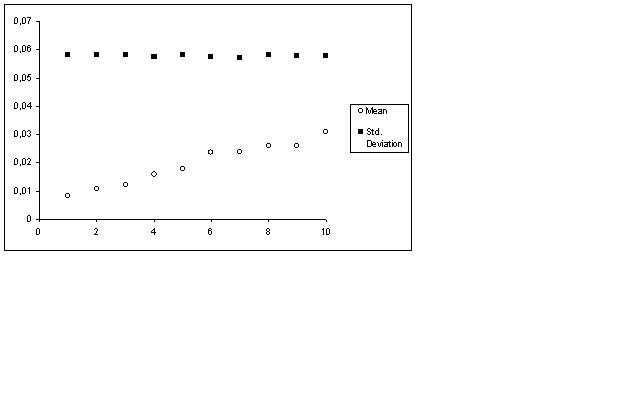

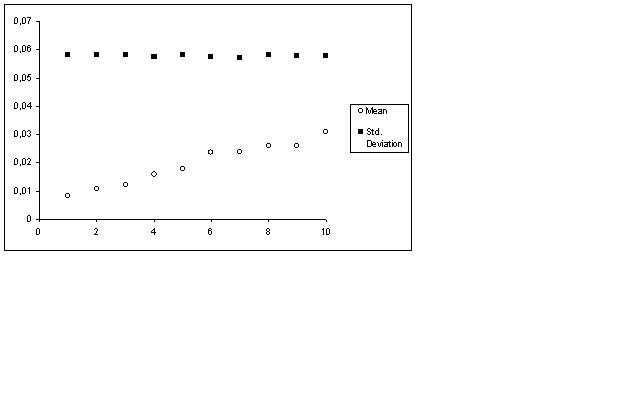

Figure 8. Profit distribution conditioned on the equity ratio, with firms grouped in 10 bins. To understand which variable is likely to be most suitable for conditioning, we start considering one of the basic hypothesis at the root of the model mechanics, that is the fact that an heavy indebted firm is forced to use a large amount of its revenues to pay for its financial commitments, instead of using it for real investments. In other terms, a high leverage is likely to reduce the profitability index. The analysis of the relationship between profit rate and equity ratio, conducted by means of nonparametric regression, returns an upward sloping trend (Figure 8) as one would expect from the theoretical model, and in line with what recorded for empirical data. Furthermore, simulations show that the rate of profit distribution shifts to the right when conditioning on the equity ratio, and that the probability to fail does not depend on the size but only on the financial position. This is important for the analysis to follow, suggesting that to address the mixture problem it is sufficient to compute firms' distributions conditional on the equity ratio.

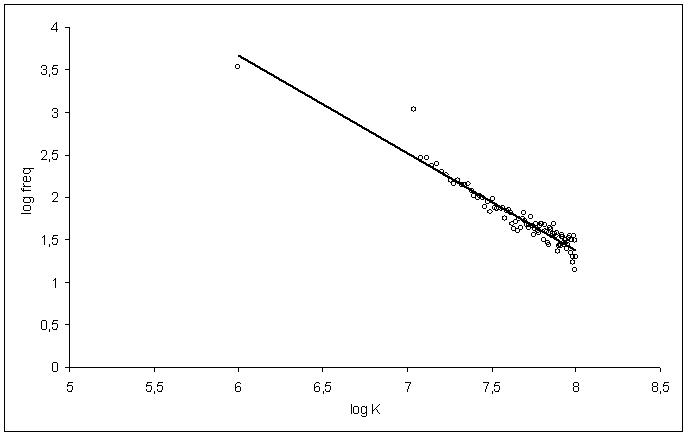

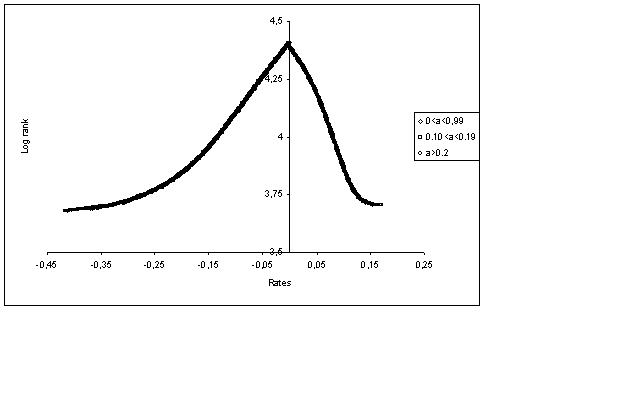

Figure 9. Zipf plot of firms dimension sorted by equity ratio (a). Hence, the power law behavior of the firms' size distribution is analyzed partitioning the [0,1] interval, to which a belongs, in several bins (chosen according to a percentile allotment). Figure 9 shows that data from different distributions conditioned on the equity partition [0, 0.1734], (0.1734, 0.2269], (0.2269, 0.3319] collapse on the same interpolating line, a clear sign of self-similarity, thus signaling that the unconditional distribution of firms' size is likely to display a scaling behavior because of its true nature and not due to spurious mixing. As one would expect by combining this finding and the results summarized in Section 3, the level of the equity ratio seems not to have any influence on the relative growth of firms, since the conditional distributions of growth rates, sorted in bins according to their financial position, invariably collapse on the same curve. To summarize, of the two forms of heterogeneity in the model - i.e., firms' financial position and age - the one that really matters in firms' behavior is the former, here measured by the equity ratio a. The analysis above shows that the scaling and the self-similarity properties - phenomena which suggest complex behaviors - do not depend on the aggregation of different economic units but it is an intrinsic property of an economic system with interacting units buffeted with idiosyncratic multiplicative shocks.

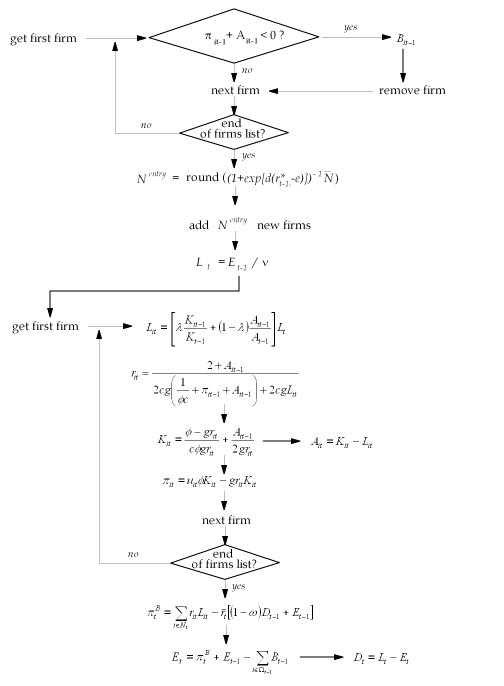

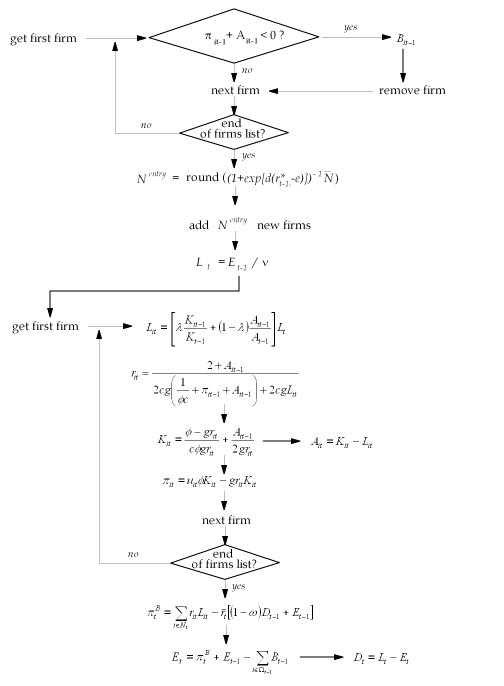

Figure 10. Distributions of firms' growth rates partitioned according to their equity ratio. 6. Conclusions Scaling phenomena and power law distributions are rather unfamiliar concepts for scholars interested in business cycle theory, regardless of the fact that these objects have been studied in economics since a long time. The reason for this neglectfulness should be looked for in the reductionism methodology which has so far permeated modern macroeconomics. Our position is that the reductionism paradigm is not only theoretically unsatisfying, but it can also be falsified as soon as proper new stylized facts are isolated. Concepts and methods inspired from physics have revealed particularly useful in detecting new facts and guiding theory formation. This paper aims at popularize the scaling approach to business fluctuations, by discussing some scaling-based ideas involved in viewing the macroeconomy as a complex system composed of a large number of heterogeneous interacting agents (HIAs). In particular, we present a simple agent-based model of the levered aggregate supply class developed by Greenwald and Stiglitz (1990, 1993), whose core is the interaction of heterogeneous financially fragile firms and a banking sector. In order to grasp the empirical evidence we adopt a methodological approach based on agent-based simulations of a system with HIAs. In our framework, the origin of business fluctuations can be traced back to the ever changing configuration of the network of heterogeneous interacting firms. Simulations of the model replicate surprisingly well an impressive set of stylized facts, particularly two well known universal laws: i) the distribution of firms' size (measured by the capital stock) is skewed and described by a power law; ii) the distribution of the rates of change of aggregate and firms' output follow a similar Laplace distribution. So far, the literature has dealt with stylized facts (i) and (ii) as if they were independent. We have discussed as that power law distribution of firms'size lays at the root of the Laplace distribution of growth rates. The model can be extended in a number of ways to take into account, among other things, the role of aggregate demand, different degrees of market power on the goods and credit markets, technological change, policy variables, learning processes, etc. Our conjecture, however, is that the empirical validation of more complex models will be due to the basic ingredients already present in the benchmark framework: the power law distribution of firms' size and then associated Laplace distribution of growth rates which in turn can be traced back to the changing financial conditions of firms and banks. Appendix In this appendix we briefly describe the assumptions and procedures we followed to simulate the model. A simulation is completely described by the parameter values, the initial conditions and the rules to be iterated period after period. First of all, we set the parameter values and the initial conditions for state variables needed to start the simulation. There parameters of the model are relative to the firm, bank and the entry process. For the firm we have: - the productivity of capital f ,

- the parameter of the bankruptcy cost equation c,

- the firm's equity-loan ratio a ,

- the variable cost parameter g

For the bank: - the mark down on interest rate w ,

- the weight the bank gives to the capital in allotting the credit supply l .

For the entry process: - the location parameter d,

- the sensitivity parameter e,

- the size parameter

They are set as follows: f = 0.1 ; c

= 1 ; a = 0.08, g = 1.1 ; w = 0.002, l =0.3, d = 100,

e = 0.1.  must be set

according to the initial number of firms (see below). The first step of

the simulation occurs at time t=1. To perform calculations in period

1 for each firm we must set initial conditions for firms' capital, the

equity base, profit and bad debt. We chose the following values Ki0

= 100, Ai0 = 20, Li0

= 80, p i0 = 0, Bi0

= 0. We run simulations for several values of initial firms and for different

number of iterations. In the simulation we report on Section 5 the initial

number of firms was set to 10000 and the number of iterations to 1000.

Given the initial number of firms, we set must be set

according to the initial number of firms (see below). The first step of

the simulation occurs at time t=1. To perform calculations in period

1 for each firm we must set initial conditions for firms' capital, the

equity base, profit and bad debt. We chose the following values Ki0

= 100, Ai0 = 20, Li0

= 80, p i0 = 0, Bi0

= 0. We run simulations for several values of initial firms and for different

number of iterations. In the simulation we report on Section 5 the initial

number of firms was set to 10000 and the number of iterations to 1000.

Given the initial number of firms, we set  .

The main loop is described in the following algorithm. .

The main loop is described in the following algorithm.

References Amaral L., Buldyrev S., Havlin S., Leschhorn H., Maas P., Salinger M., Stanley E. and M. Stanley (1997), Scaling Behavior in Economics: I. Empirical Results for Company Growth, Journal de Physique, 7:621-633. Amaral L., Buldyrev S., Havlin S., Salinger M. and E. Stanley (1998), Power Law Scaling for a System of Interacting Units with Complex Internal Structure, Physical Review Letters, 80:1385-1388. Aoki M. (1996), New Approaches to Macroeconomic Modeling. Cambridge: Cambridge University Press. Arrow K. (1951), Social Choice and Individual Values. Wiley & Sons, new York. Axtell R. (1999), The Emergence of Firms in a Population of Agents: Local Increasing Returns, Unstable Nash Equilibria, and Power Law Size Distributions, CSED Working Paper No.3. Axtell R. (2001) Zipf Distribution of U.S. Firm Sizes, Science, 293:1818-1820. Bak P. (1997), How Nature Works. Oxford University Press, Oxford. Bak P., Chen K., Scheinkman J. and M. Woodford (1993), Aggregate Fluctuations from Independent Sectoral Shocks: Self-Organized Criticality in a Model of Production and Inventory Dynamics, Ricerche Economiche, 47:3-30. Blank A. and s. Solomon (2000), Power Laws in Cities Population, Financial Markets and Internet Sites, Physica A, 287:279-288. Bottazzi G. and A. Secchi (2003), A General Explanation for the Laplace Distribution of Firms' Growth Rates, mimeo. Brock W. (1999), Scaling in Economics: A Reader's Guide, Industrial and Corporate Change, 8:409-446. Canning D., Amaral L., Lee Y. Meyer M. and E. Stanley (1998), Scaling the Volatility of GDP Growth Rates, Economics Letters, 60:335-341. Carroll C. (2001), Requiem for the Representative Consumer? Aggregate Implications of Microeconomics Consumption Behavior, American Economic Review, 90:110-115. Caves R., (1998), Industrial Organization and New Findings on the Turnover and Mobility of Firms, Journal of Economic Literature, 36:1947-1982. Cont R., Potters M. and J.-P. Bouchad (1997), Scaling in Stock Market Data: Stable laws and Beyond, in Dubrulle B., Graner F. and D. Sornette (eds), Scale Invariance and Beyond. EDP Science, Les Ulis. Davis S., Haltiwanger J. and S. Schub (1996), Job Creation and Destruction. MIT Press, Cambridge. Delli Gatti D., Di Guilmi C., Gallegati M. and G. Giulioni G. (2003a), Financial Fragility, Industrial Dynamics and Business Fluctuations in an Agent Based Model, Macroeconomic Dynamics, forthcoming. Delli Gatti D., Gallegati M., Giulioni G. and A. Palestrini (2003b), Financial Fragility, Patterns of Firms' Entry and Exit and Aggregate Dynamics, Journal of Economic Behavior and Organization, 51:79-97. Delli Gatti D., Di Guilmi C., Gaffeo E., Gallegati M., Giulioni G. and A. Palestrini (2003c), Firms' Size Distribution and Growth Rates as Determinants of Business Fluctuations, mimeo. Delli Gatti D., Di Guilmi C. and M. Gallegati (2003d), On the Empirics of "Bad Debt", mimeo. Di Guilmi C., Gaffeo E. and M. Gallegati (2003), Empirical Results on the Size Distribution of Business Cycle Phases, mimeo. Durlauf S. (2003), Complexity and Empirical Economics, mimeo. Feller W. (1957), An Introduction to Probability Theory and its Applications. Wiley, New York. Forni M. and M. Lippi (1997), Aggregation and the Microfoundations of Dynamic Macroeconomics. Oxford University Press, Oxford. Fujiwara Y. (2003), Data Analysis of Japanese Bankruptcy, mimeo. Fujiwara Y., Di Guilmi C., Aoyama H., Gallegati M. and W. Souma (2003), Do Pareto-Zipf and Gibrat's Laws Hold True? An Analysis with European Firms, mimeo. Gabaix X. (1999), Zipf's Law for Cities, Quarterly Journal of Economics, 114:739-766. Gabaix X. (2003), Power Laws and the Origins of Macroeconomic Fluctuations, mimeo. Gaffeo E., Gallegati M. and A. Palestrini (2003), On the Size Distribution of Firms. Additional Evidence from the G7 Countries, Physica A, 324:117-123. Gallegati M., Giulioni G. and N. Kichiji (2003), Complex Dynamics and Financial Fragility in an Agent Based Model, Computational Science, forthcoming. Gibrat R. (1931), Les Inégalités Economiques, Applications: Aux Inégalités des Richesses, à la Concentration des Entreprises, aux Populations des Ville, aux Statistiques des Familles, etc., d'une Loi Nouvelle, la Loi de l'Effet Proportionnel. Librarie du Recueil Sirey, Paris. Gnedenko B. and A. Kolmogorov (1954), Limit Distributions for Sums of Independent Random Variables. Addison-Wesley, Reading. Greenwald B. and J. Stiglitz (1990), Macroeconomic Models with Equity and Credit Rationing, in Hubbard R. (ed.), Information, Capital Markets and Investment. Chicago: Chicago University Press. Greenwald B. and J. Stiglitz (1993), Financial Markets Imperfections and Business Cycles, Quarterly journal of Economics, 108:77-113. Grossman S. and J. Stiglitz (1980), On the Impossibility of Informationally Efficient Markets, American Economic Review, 70:393-408. Hahn F. (1982), Money and Inflation. Oxford: Blackwell. Härdle W. (1990), Applied Nonparametric Regression. Cambridge University Press, Cambridge. Hildebrand W. (1994), Market Demand. Princeton University Press, Princeton. Hildebrand W. and A. Kirman (1988), Equilibrium Analysis. North-Holland, Amsterdam. Hopenhayn H. (1992), Entry, Exit and Firm Dynamics in Long-run Equilibrium, Econometrica, 60:1127-1150. Hubbard G., Kuttner K. and D. Palia (2002), Are There "Bank Effects" in Borrowers' Costs of Funds?: Evidence from a Matched Sample of Borrowers and Banks, Journal of Business, 75:559-581. Ijiri Y. and H. Simon (1977), Skew Distributions and the Sizes of Business Firms. North-Holland, New York. Kirman A. (1992), Whom or What Does the Representative Individual represent?, Journal of Economic Perspectives, 6:117-136. Krugman P. (1996), The Self-Organizing Economy. Cambridge, Blackwell. Lee Y., Amaral L., Canning D., Meyer M. and E. Stanley (1998), Universal Features in the Growth Dynamics of Complex Organizations, Physical Review Letters, 81:3275-3278. Lebwel A. (1989), Exact Aggregation and the Representative Consumer, Quarterly Journal of Economics, 104:621-633. Mandelbrot B. (1960), the Pareto-Levy Law and the Distribution of Income, International Economic Review, 12:79-105. Mantegna R. and E. Stanley (2000), An Introduction to Econophysics. Cambridge University Press, Cambridge. Mantel R. (1976), Homothetic Preferences and Community Excess Demand Functions, Journal of Economic Theory, 12:197-201. Marshall A. and I. Olkin (1967), A Multivariate Exponential Distribution, American Statistical Association Journal, :30-44. Marsili M. and Y.-C. Zhang (1998), Interacting Individuals Leading to Zips' Law, Physical Review Letters, 80:2741-2744. Nørrelykke S. and P. Bak (2002), Self-Organized Criticality in a Transient System, Physics Review, 68. Palestrini A. (2003), Statistical Analysis of Industrial Dynamics: The Relationship Between Firms' Size and Growth Rate, mimeo. Pareto V. (1897), Course d'Economie Politique, Vol.2. Pichou, Paris. Rebelo S. (1991), Long-run Policy Analysis and Long-run Growth, Journal of Political Economy, 99:500-521. Reed W. (2001), The Pareto, Zipf and Other Power Laws, Economics Letters, 74:15-19. Resnik S. (1987), Extreme Values, Regular Variation, and Point Processes. New York: Springer Verlag. Schumpeter J,. (1937), Business Cycles. Mc Graw Hill, New York. Simon H. (1955), On a Class of Skew Distribution Functions, Biometrika, 27:425-440. Sonnenschein H. (1972), Market Excess Demand Functions, Econometrica, 40:549-563. Sornette D. (2000), Critical Phenomena in Natural Sciences, Chaos, Fractals, Self-Organization and Disorder. Concepts and Tools. Springer, Heidelberg. Stanley M., Amaral L., Buldyrev S., Havlin S., Leschorn H., Maas P., Salinger M. and E. Stanley (1996), Scaling Behavior in the Growth of Companies, Nature, 379:804-806. Steindl J. (1965), Random Processes and the Growth of Firms. Hafner, New York. Stoker T. (1993), Empirical Approaches to the Problem of Aggregation Over Individuals, Journal of Economic Literature, 21:1827-1874. Strahan P. (1999), Borrower Risk and the Price and Nonprice Terms of Bank Loans, Federal Reserve Bank of New York working paper. Winter S., Kaniovski Y. and G. Dosi (1997), A Baseline Model of Industry Evolution, Interim Report 111-97-013, IIASA, Luxemburg. Zajdenweber D. (1997), Scale Invariance in Economics and in Finance, in Dubrulle B., Graner F. and D. Sornette (eds), Scale Invariance and Beyond. EDP Science, Les Ulis. |

(3)

(3) (4)

(4)

.

(12)

.

(12)